Pre-Owned Luxury Watches: Top Demand, Fake Risks & an AI Dial-Photo Pre-Check (TrustWatch)

Summary (key takeaways)

The pre-owned watch market is growing because of scarcity, collectibility, and global access, but it carries significant counterfeit and misrepresentation risk.

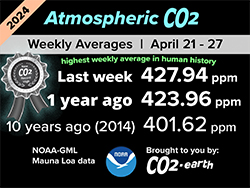

Your provided materials report large-scale economic impact (including CHF 2B/year missed Swiss watch sales and broader Swiss IPR counterfeit trade impacts).

TrustWatch by Hoken Tech provides a practical pre-owned buying advantage: upload a dial photo → get a score quickly, backed by a reported 96.20% accuracy via K-Fold Cross Validation.

Best practice is a layered approach: seller vetting + visual checks + TrustWatch screening + professional verification when necessary.The pre-owned luxury watch market has become one of the most dynamic segments in the entire watch industry. Collectors and first-time buyers alike are drawn to iconic references, discontinued models, and the chance to buy pieces that are difficult (or impossible) to obtain at retail.

The Secondary Luxury Watch Market: Demand, Risks, and a Smarter Way to Pre-Check Authenticity

The pre-owned luxury watch market gives buyers access to iconic references and discontinued models—but it also attracts superfakes, forged papers, and “Frankenwatches”. That’s why pre-purchase authentication has become a core step, not a nice-to-have.

Why the pre-owned segment is booming

Why the pre-owned segment is booming

Demand shifts to the secondary market when retail availability is limited and buyers want access to discontinued references. Digital marketplaces also make cross-border inventory easier to reach—fueling liquidity and visibility.

| Driver | What it means for buyers | Market effect |

|---|---|---|

| Scarcity | Pre-owned becomes the practical path to availability. | Prices and competition concentrate on liquid references. |

| Discontinued models | Collectors can source references no longer produced. | “Vintage + neo-vintage” segment remains highly active. |

| Global reach | More inventory via online listings and communities. | Higher velocity, faster resale cycles. |

What watches are most in demand in the secondary market (and why)

What’s most in demand in the secondary market (and why)

The most requested pre-owned watches typically share the same mechanics: recognizability, liquidity, and strong brand equity. Those same traits also make them prime targets for high-grade counterfeits.

Steel sports watches

- High versatility (daily wear)

- Strong collector “baseline demand”

- Fast resale in many markets

Iconic design lines

- Easy to recognize from a single photo

- Consistent design language across years

- Broad audience (not niche-only)

Many variants & references

- More configurations = more confusion

- More room for “Frankenwatch” swaps

- Harder to verify without diligence

Counterfeiting isn’t a side problem — it’s a systemic market threat

Demand drivers vs. counterfeit risk

The same elements that make a reference easy to buy and resell also make it attractive for counterfeiters to target at scale—especially in remote, photo-based transactions.

| Demand driver | Why buyers want it | Why counterfeit risk rises |

|---|---|---|

| Brand recognition | Easy to trade; wide audience. | High volume targets are profitable for counterfeiters. |

| Scarcity | Pre-owned is faster than waitlists. | “Too good to miss” deals reduce caution. |

| Iconic design | Instantly recognizable, culturally established. | Replicas focus on the most recognizable visuals. |

| Liquidity | Buyers feel safer with strong resale demand. | High liquidity helps fakes circulate quickly. |

Key number of fakes on the market

Counterfeiting is a systemic market threat

Beyond basic knockoffs, the market now includes high-grade “superfakes” and documentation fraud.

| Metric | Figure | Context |

|---|---|---|

| Counterfeit watches introduced yearly (estimate) | ~40 million | Global estimate reported in TrustWatch materials |

| Illicit profits (estimate) | ~USD 1 billion | Global estimate reported in TrustWatch materials |

| Missed sales for Swiss watch industry | ~CHF 2 billion / year | Swiss watchmaking impact (OECD cited in TrustWatch materials) |

| 2018 trade in counterfeit/pirated goods violating Swiss IPR | CHF 7 billion | Stated as 2.3% of authentic exports (2018) |

| Reduction in legitimate sales (2018 context) | CHF 4.5 billion | Switzerland-linked IPR impact (2018) |

| Swiss tax revenue loss | CHF 160 million | Government impact estimate |

| Jobs lost | 10,000+ | Approx. 1.7% of Swiss manufacturing jobs |

Why “traditional authentication” can fail the buyer journey

Why traditional authentication alone can fail the buyer workflow

Expert checks remain valuable, but the buyer often needs a fast filter before committing money, travel, or time. That’s where an AI pre-check can reduce wasted effort and risk earlier in the process.

What traditional inspection does well

- Hands-on evaluation of finishing, movement, and parts

- Context from experienced professionals

- Best for final confirmation on high-value deals

Where buyers struggle in real life

- Often requires having the watch in-hand (after commitment)

- Scheduling, travel, and fees add friction

- Results can be informal and hard to share consistently

TrustWatch (Hoken Tech): ML-based dial-photo scoring for faster pre-owned due diligence

TrustWatch by Hoken Tech: dial-photo scoring for pre-owned due diligence

TrustWatch is Hoken Tech’s machine-learning model designed to analyze a luxury watch starting from a single dial photo. Upload a clear image of the dial and receive a numerical score to help interpret whether the watch is likely genuine or likely counterfeit.

Open TrustWatch → https://www.hokentech.tech/trustwatchTrustWatch performance

TrustWatch model performance

The model is evaluated with K-Fold Cross Validation and reports an accuracy of 0.962 (96.20%) on tested data.

| Metric | Value | Notes |

|---|---|---|

| Accuracy | 0.962 (96.20%) | Using K-Fold cross validation |

| Validation | K-Fold Cross Validation | Used to evaluate generalization on tested data |

| Training approach | Supervised learning | Trained on labeled images of genuine vs counterfeit watches |

A repeatable “safe-buy” flow for pre-owned watches (with TrustWatch)

TrustWatch workflow (built for speed)

There are a simple three-step flow: upload a dial photo, let the AI analyze it, then share the result.

| Step | Action | Time (reported) |

|---|---|---|

| 1 | Upload a clear photo of the dial (good lighting, low reflections). | ~1 minute |

| 2 | AI analyzes the image and generates a score. | ~3 seconds |

| 3 | Save / screenshot and share results with others if needed. | ~1 minute |

A repeatable safe-buy flow (pre-owned watches)

Combine seller checks, visual checks, and a fast AI pre-check before you commit. Use TrustWatch here: hokentech.tech/trustwatch.

-

1

Vet the seller

Check transparency, identity, reviews, and willingness to provide high-quality photos.

-

2

Collect proper dial photos

Ask for straight-on dial shots with good lighting and minimal reflections.

-

3

Run TrustWatch

Upload the dial photo and get a numerical score in seconds.

-

4

Decide next steps

If risk is high, stop. If it looks good, proceed with provenance + (for big deals) professional inspection.

-

5

Archive evidence

Save listing images, messages, receipts, and screenshots for resale/insurance/disputes.

The secondary market is where luxury watches are bought and sold after their first retail purchase. It includes private sales, dealers, marketplaces, and auctions. Buyers often use it to access scarce or discontinued references.

Some watches trade above retail because demand exceeds supply, waitlists are long, and certain references are considered highly liquid. Condition, completeness (box/papers), and provenance can also raise value. Price premiums vary widely by brand and reference.

“Superfakes” are high-quality counterfeits made to closely imitate genuine watches. They’re dangerous because they can look convincing in photos and even in hand, making buyers more likely to get fooled — especially in remote transactions.

A Frankenwatch is a watch assembled using mixed parts (some may be genuine, others not), then sold as fully original. This can seriously impact value, insurability, and resale even if some components are authentic.

Start by verifying the seller, demanding clear photos, and comparing the watch to known specifications.

Then use a fast pre-check tool such as TrustWatch to screen risk from a dial photo: https://www.hokentech.tech/trustwatch.

For high-value purchases, follow with a professional in-person inspection.

TrustWatch lets you upload a photo of the dial, then uses a supervised machine-learning model to analyze visual features (logo, dial details, hands, markers, and more). It returns a numerical result to help you interpret whether the watch is more likely genuine or counterfeit.

According to Hoken Tech’s published materials and the TrustWatch page, the model achieved 96.20% accuracy (0.962) using K-Fold Cross Validation. It is not a perfect system, and it should be used alongside other checks and professional authentication when needed.

No. TrustWatch is designed as a fast pre-check that can reduce risk early in the buying process. For final certainty — especially on expensive pieces — professional verification remains recommended.

Use a straight-on dial photo with good lighting and minimal reflections. The TrustWatch page explicitly recommends a nice dial photo with good illumination and avoiding reflections for better precision.

You can access it directly here: https://www.hokentech.tech/trustwatch

nft, hoken tech, blockchain, cryptoart, eos, nft art, artificial intelligence, ai, watch authentication, crypto artist, nfts, web3, nft game, web3 game, videogame, nft distributor, videogame blockchain